Last week, the Fed officially provided the market with a planned rate cutting cycle beginning in 2024, and as a result, the consensus ‘24 forecast now calls for 3 consecutive 25 bp cuts in March, May, and June.

The resulting buying pressure across US stocks was powerful, and has lead to some rare occurrences in the technical landscape.

At the index level, the S&P 500 is at its most overbought level (RSI >70) since 2020, and nearing its most overbought levels in a decade.

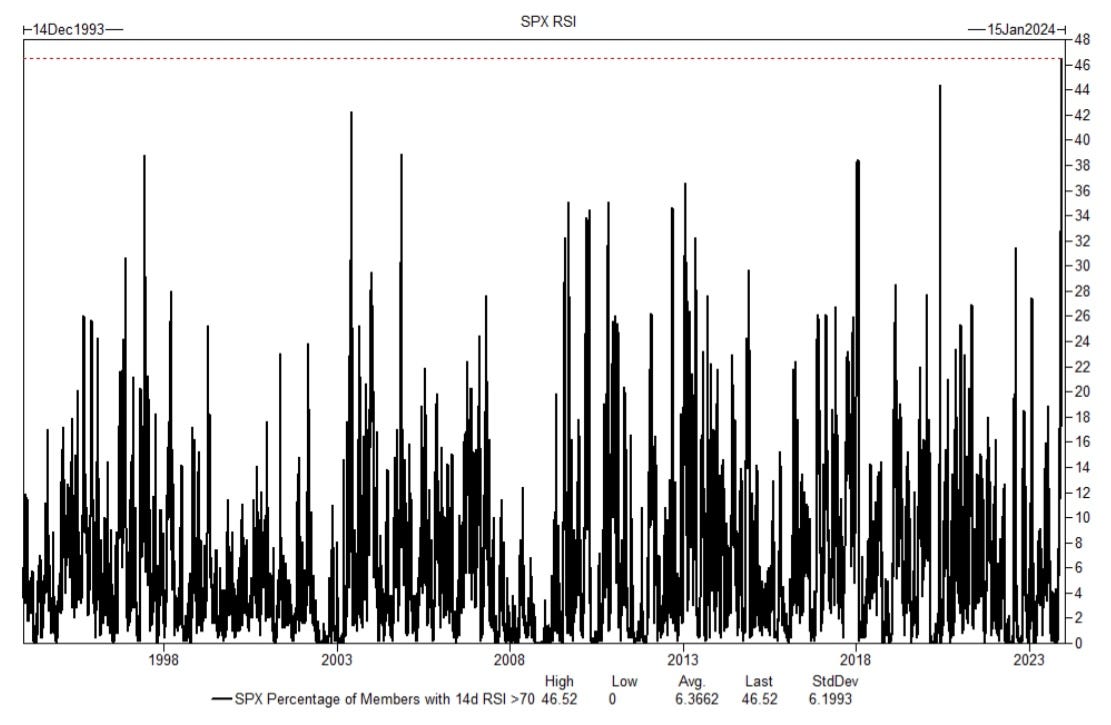

Under the hood, 46% of SPX members have a 14d RSI >70, the most in 30+ years, and 2nd most of all time (behind only 1 data point in 1991).