Friday Morning Notes 11.22

Daily Market Commentary:

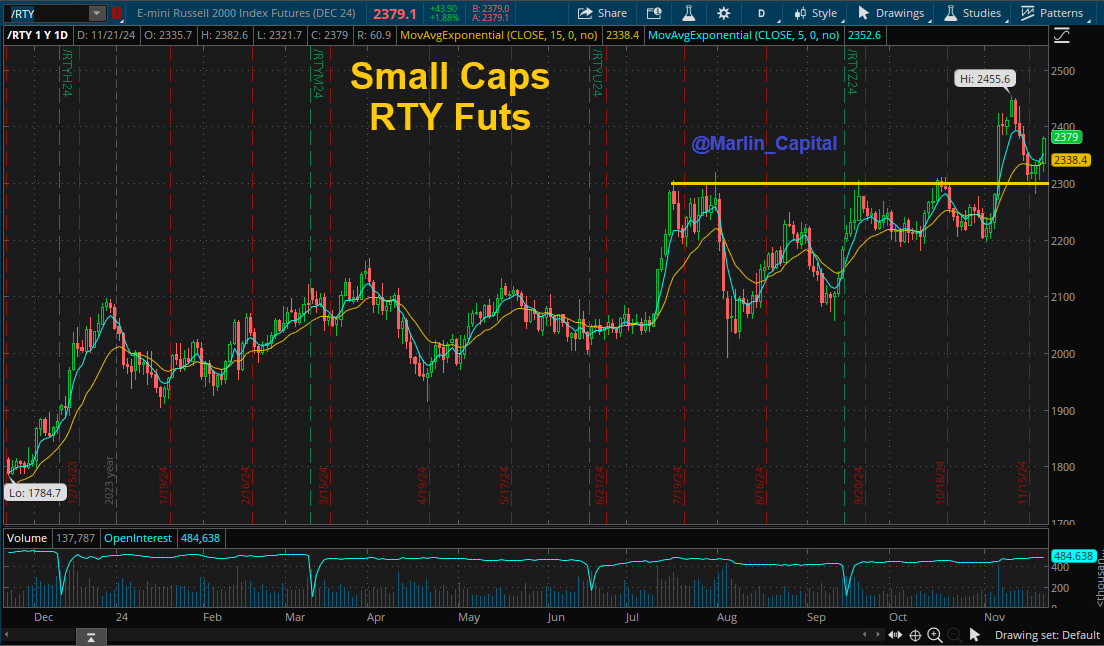

The market rallied yesterday with a rotation trade in full effect (RTY > NDX by ~130bps). Regulatory headlines continue to weigh on Mega Caps (GOOGL was -5% and AMZN -2%), which allowed investors to lean into more speculative areas of the market (small caps, crypto, etc.).

NVDA finished +50bps through a volatile 6% intraday swing. The numbers were a touch light versus blue sky expectations, but good enough for the company to eclipse $4T in market cap.

Looking back, the greatest lesson I can give in NVDA is to always trust in your own convictions. I’ve owned a piece of this stock since 2017. It was 1 of my first 4 stock buys after I entered the Wealth Management industry (RIA) and I recommended it to my boss at the time to buy for all our clients. She didn’t like it and thought it was “too risky”. Stuck with Intel instead. I held through multiple Bear Markets, China trade wars -60% drawdowns, and the March 2020 Covid crash. This is why I prefer long term investments sit in your IRA as you can truly have a long term outlook on a business when you don’t need the money any time soon. Nvidia is now the largest company on earth.

Now back to the current market. As for Small Caps, it doesn’t get much more bullish than this. We saw a 4 month base breakout on volume following the US election, followed by a successful retest of the previous $2300 breakout level.

Make sure you continue to own my Top 6 Small Caps picks. This is my favorite way to play the breakout in Small Caps. We are already seeing life changing gains in the Small Cap 6!