US stocks finished ~70bps lower yesterday, finally snapping the longest S&P winning streak in 20+ years (9 days). It was a very quiet session with trading volumes tracking -32% vs 20d avg.

On the data front, ISM Services was better than feared, but prices paid were the highest since February 2023. There were 13 mentions of tariffs in the April press released, compared to 13 in March and 5 in January.

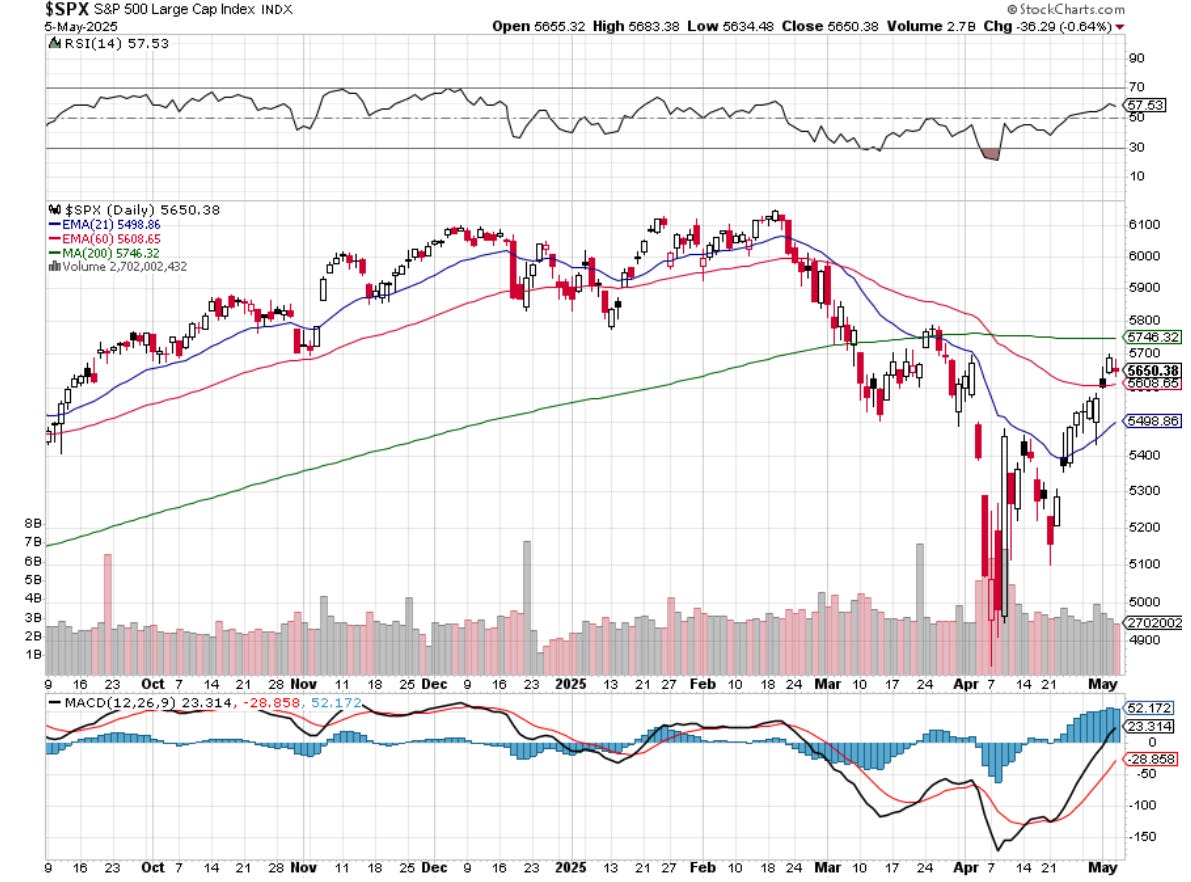

US stocks are pulling back ~1% so far this morning. All eyes are on tomorrow’s Fed meeting now. The Fed is certainly a potential bearish catalyst for stocks, but if the market can avoid this landmine, I remain bullish here in the near future. Here’s why…

It all starts with Systematic buying.

Systematic Fund flows remain extremely favorable here. According to Nomura, US equities benefitted from $61B+ of mechanical/systematic flows last week. My research shows that this reallocation buying is still in the early stages and systematic demand will continue to be substantial moving forward.