The headline driven action continued for US stocks yesterday. The market initially gapped down big on tariff news, but later turned around on news of tariff delays.

The market rallied big when it was confirmed that the tariffs on Mexico would be delayed by a month, with a similar step then confirmed for Canada shortly after the US equity close. The SPX had been down as much as -2% early in the session, but bounced nicely after the Mexico tariff delay news hit and finished -0.76%.

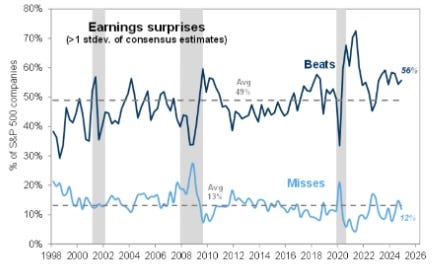

While the indices are very headline driven right now, the good news is we’re seeing plenty of positive earnings reactions. So far through earnings season, 56% of companies reporting have beat street wide estimates by >1SD (higher than historical avg. of 49%), while 12% of companies have missed estimates by >1SD (slightly less than historical avg. of 13%).

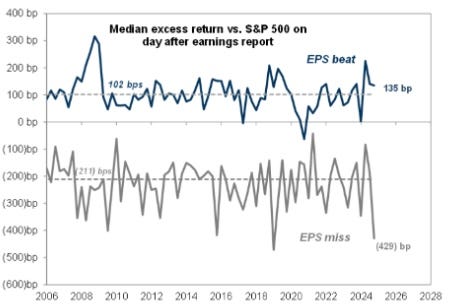

Companies beating estimates by at least 1SD have outperformed the S&P 500 by +135bps on the trading session directly after reporting (vs historical avg. of +102 bps of outperformance). On the other hand, companies missing earnings estimates by >1SD have underperformed the SPX by -429bps (significantly worse than the historical avg. of -211bps).

My focus is always on companies that are beating earnings, specifically the ones raising guidance as well. Then, I look for the most positive Wall Street reactions to these earnings beats, which shows itself in volume and price. So far, we have a couple stocks that really stand out for me.