Today was a strong day for the market as April CPI showed a continued deceleration in inflation (3.36% YoY in April from 3.48% in March). The indices responded with 100bp+ gains all around (SPX +1.17%, QQQ +1.56%, IWM +1.25%).

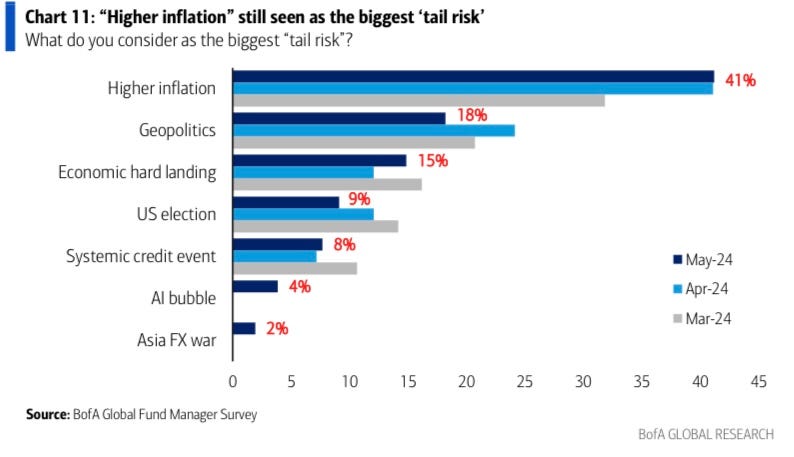

Leading up to today, Fund Managers voting in BofA’s May FMS survey identified higher inflation as the biggest tail risk to the market.

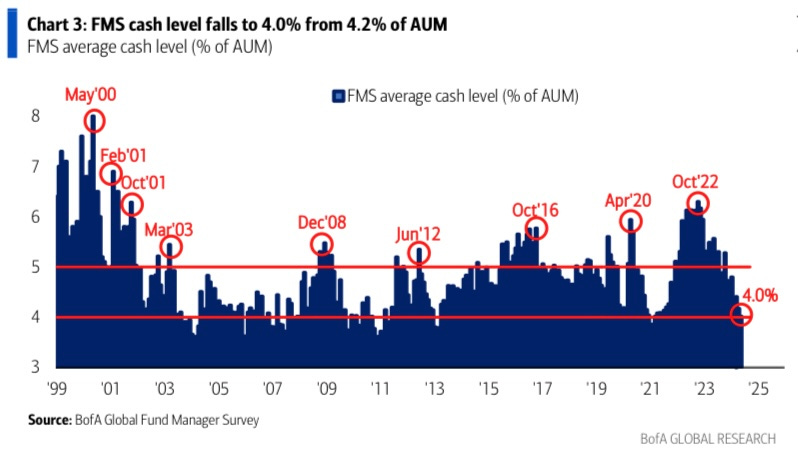

Today’s benign CPI reading (Core MoM coming in +29bps unrounded, 1bp below consensus and the slowest pace since December) has helped to alleviate some of that tail risk (at least, for now). According to BofA’s May FMS Survery, Fund Managers had already been taking down their cash levels. The average cash level of FMS investors surveyed fell to 4.0% of AUM in May from 4.2% in April, now the lowest since June 2021.

With CPI out of the way, we may see Fund Managers continue to put more cash to work here. This, along with Corporate Buybacks (90%+ now in their open window), loosening Financial Conditions, and the major indices breaking out to new highs after the ~8% mini-correction in April (QQQ) bode well for a continued Summer rally in the indices.