No Guidance

A very clear theme is emerging in Q1 Earnings season so far. Detailed analysis below...

US stocks were mixed last week (SPX -1.5%, NDX -2.3%, RTY +1.2%) as investors continue to struggle against US Trade Policy uncertainty and comb through data of the early Q1 Earnings reports for signs of whether (and how much) of the economic damage is already baked in.

The good news is - the US Stock Market has stabilized since the announcement of the 90-day tariff pause. In “Hard Dollar”, I wrote:

“The 90-day tariff pause announcement removed the extreme Bear Case scenario (deep recession + $220 EPS) from the market, which has allowed stocks to stabilize since last Wednesday.

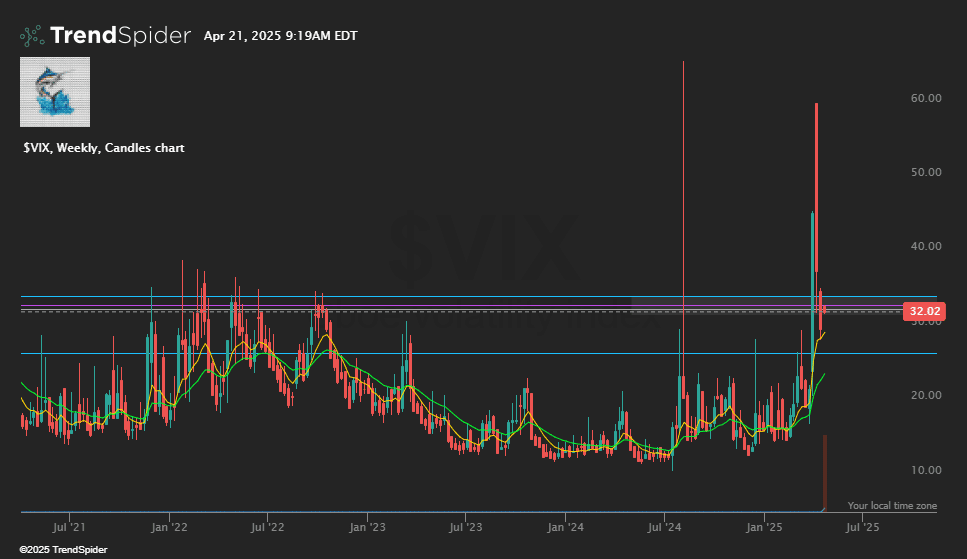

Trading volumes have normalized after seeing the 3 highest volume sessions in the history of the US stock market. The VIX (which I have predicted likely already peaked for this cycle at ~60), has continued to move downwards and finished last week below 30 for the first time since late March. A peak in the VIX would mean that we are past the point of peak fear/volatility (which, in turn, allows the market bottoming process to begin).