Not Your Average Recession

Recession odds hit 73%, yet SPX holds firm. Is the market bottom in? Detailed analysis below…

Today’s Q1 GDP print came in at a disappointing -0.3% (vs +0.3% exp), raising the stakes for Q2. If Q2 GDP comes in negative, it means that we are currently in a recession.

Polymarket’s recession odds spiked to 73% post-GDP release, a new cycle high. It has now settled in at 67% (as of this writing).

Source: Polymarket

For context, the last time we saw Polymarket recession odds this high was April 7th, (~67%), when the S&P 500 was trading below $5000. Yet, the SPX is still +13% off its lows, showing resilience despite recession odds climbing to new highs.

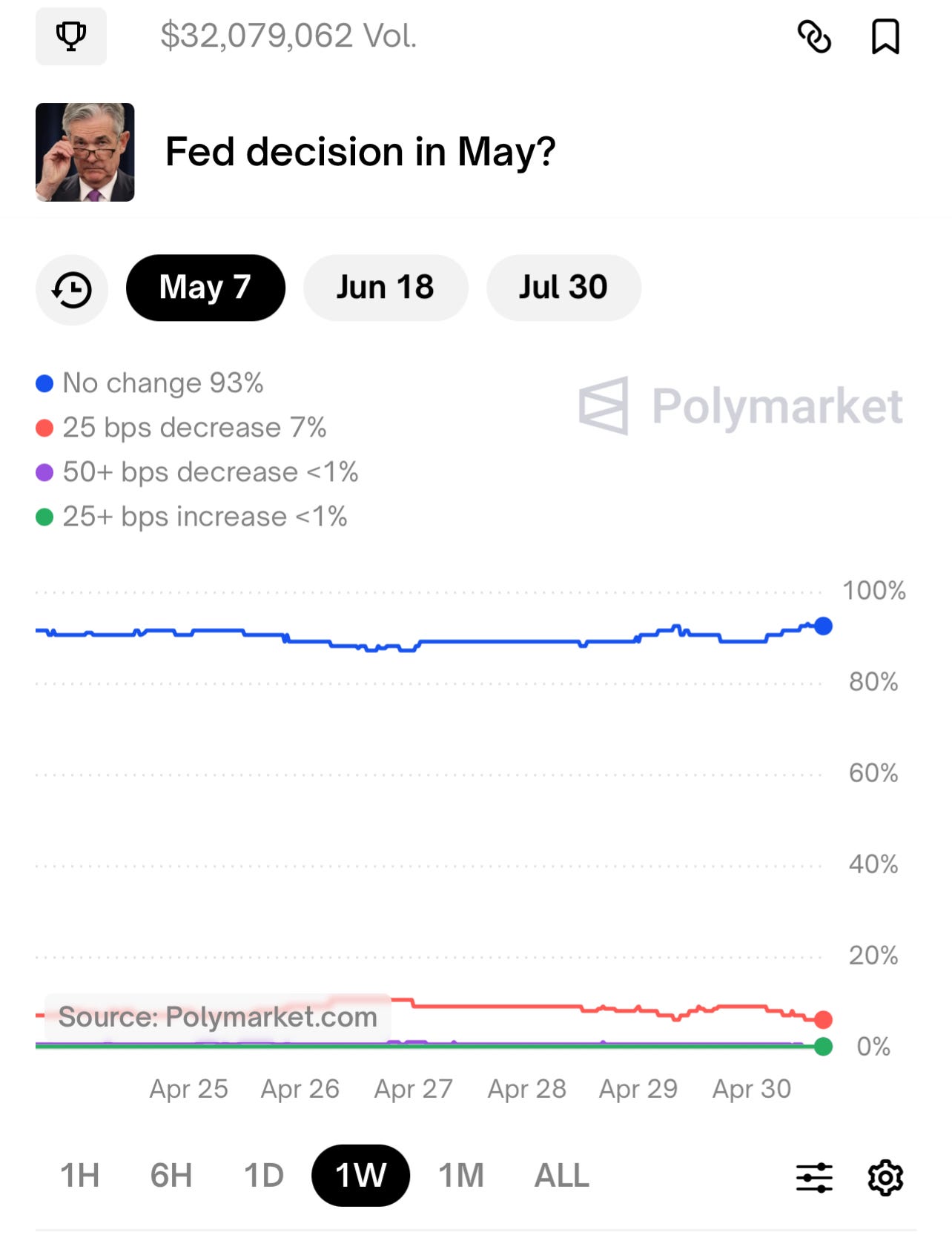

The Fed's current unsupportive stance adds a layer of complexity to the equation. Despite today’s negative GDP data, Polymarket still assigns a 93% probability of no rate cut in May, largely unmoved today.

Source: Polymarket

Historically, the Fed almost always cuts rates during economic recessions. Let’s take a look back at the last 5 economic recessions to see how the Fed was reacting, and what it meant for US stocks: