Stocks finished this choppy trading week on a high note today with the SPX rallying +1% to close out the week. The S&P 500 ended up finishing the week +1.8% higher despite yesterday’s Trump & Musk feud on X.

TSLA dropped -14% yesterday and contributed to ~40% of the SPX move lower. Elsewhere, the action has been mixed in recent trading days with the indices still trading within their 2-3 week ranges. We closed at the highs of that trading range on Friday, as today’s close is the first above $6000 for the SPX since February 21st.

What’s driven this rally back above SPX $6000?

Positioning (re-leveraging, systematic, and forced buying)

A more resilient economy than expected

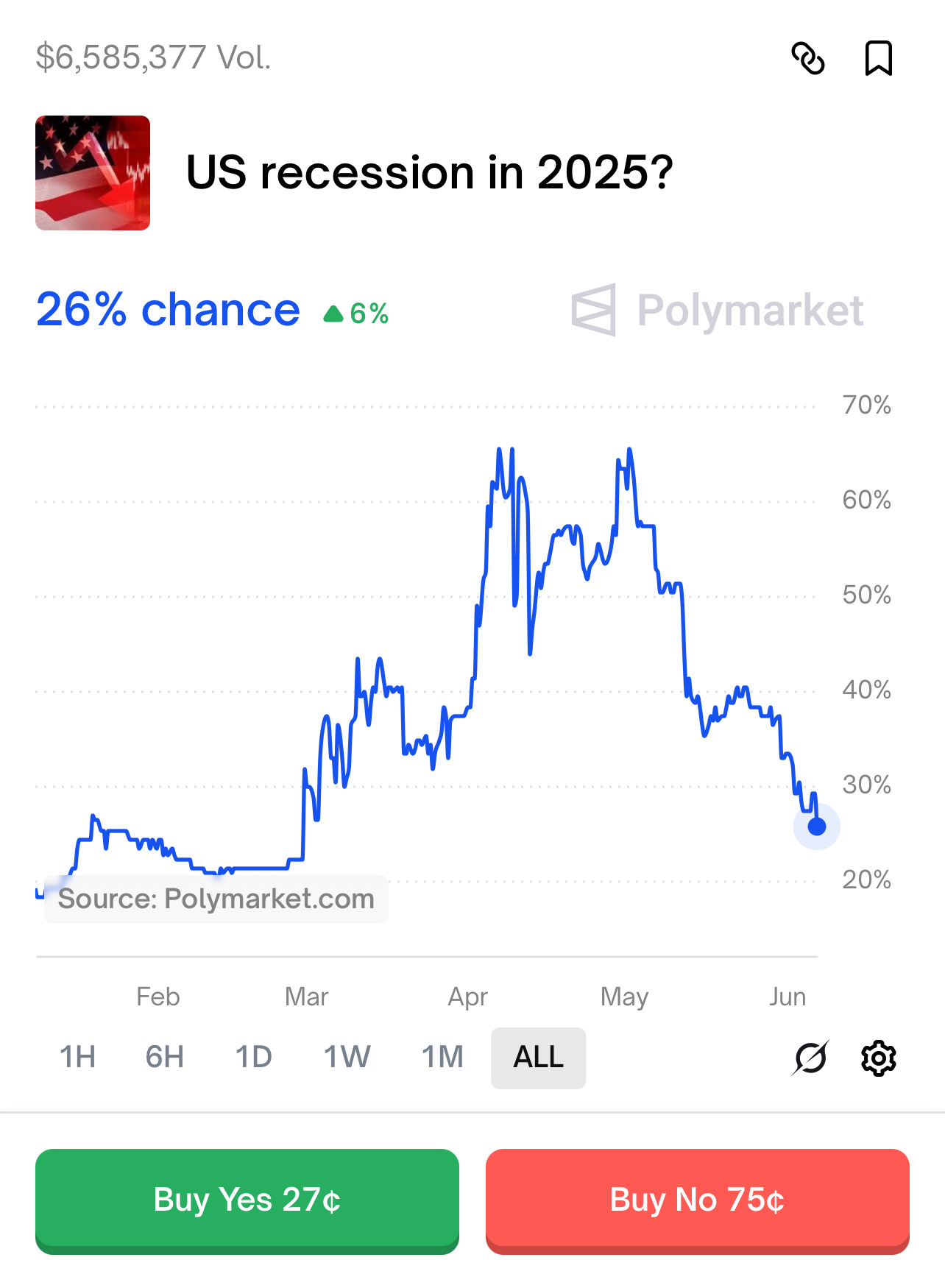

On the 2nd point, stocks have stabilized in large part due to sharply declining recession odds. In fact, Polymarket recession odds for 2025 now sit at just 26%.

Source: Polymarket

Remember, odds of a US recession in 2025 reached a high of ~67% following Liberation Day. A recession has essentially been “priced out” of the market since the announcement of the 90-day tariff pause and the economic data we have seen in the last month.

All-time highs are the next step for the indices. Leaders are already there. We are having ourselves a terrific month here at Marlin Capital on my top 4 trade ideas from Q1 earnings.

Long Term Portfolios:

New SMID-Cap Multi-Bagger Portfolio: To be released this Sunday/Monday

Trump Trades and Top 2025 AI Picks.

Active Portfolio

Another solid day in our leaders.