US stocks finished in the red last week (SPX -2.6%, NDX -2.4%, RTY -3.5%) as investors digest the Moody’s downgrade of debt along with continued tariff uncertainties.

With all the noise around tariffs and the volatile Macro backdrop this year, I think it is important not to lose sight of the big picture here.

The big picture is that we are in the early stages of a technological revolution, the likes of which we have only seen a few times in history. AI is going to drastically change our world in the next decade. In the next 5-10 years, we are likely to see massive technological breakthroughs in industries like healthcare, transportation (autonomous), robotics, security & defense, etc. This could potentially drive a golden age for our economy.

In this way, I view the Q1 2025 Bear Market/Tariff Tank as comparable to the 1998 market correction. Back then, the market took a hit from short term Macro driven noise (LTCM collapse), but it was also the dawn of the internet revolution.

Fast forward to Q1 2025, and the Q1 tariff driven correction has a similar vibe to me now (a deep market correction shakeout in the face of a massive technological shift).

AI is the new internet. 5 years from now, tariffs will not even be a story. The pace of AI progress will be.

Elon Musk and Sam Altman have both predicted Artificial General Intelligence (AGI) by 2030, with biological intelligence potentially encompassing to just 1% of total intelligence (AI the other 99%).

Along these lines, I will be unveiling my new long term portfolio of my top 6 SMID-Cap AI stocks (potential multi baggers) uniquely positioned to ride the AI wave in exploding industries, in early June.

The Week Ahead

In today’s report, I am focusing on the trading week ahead.

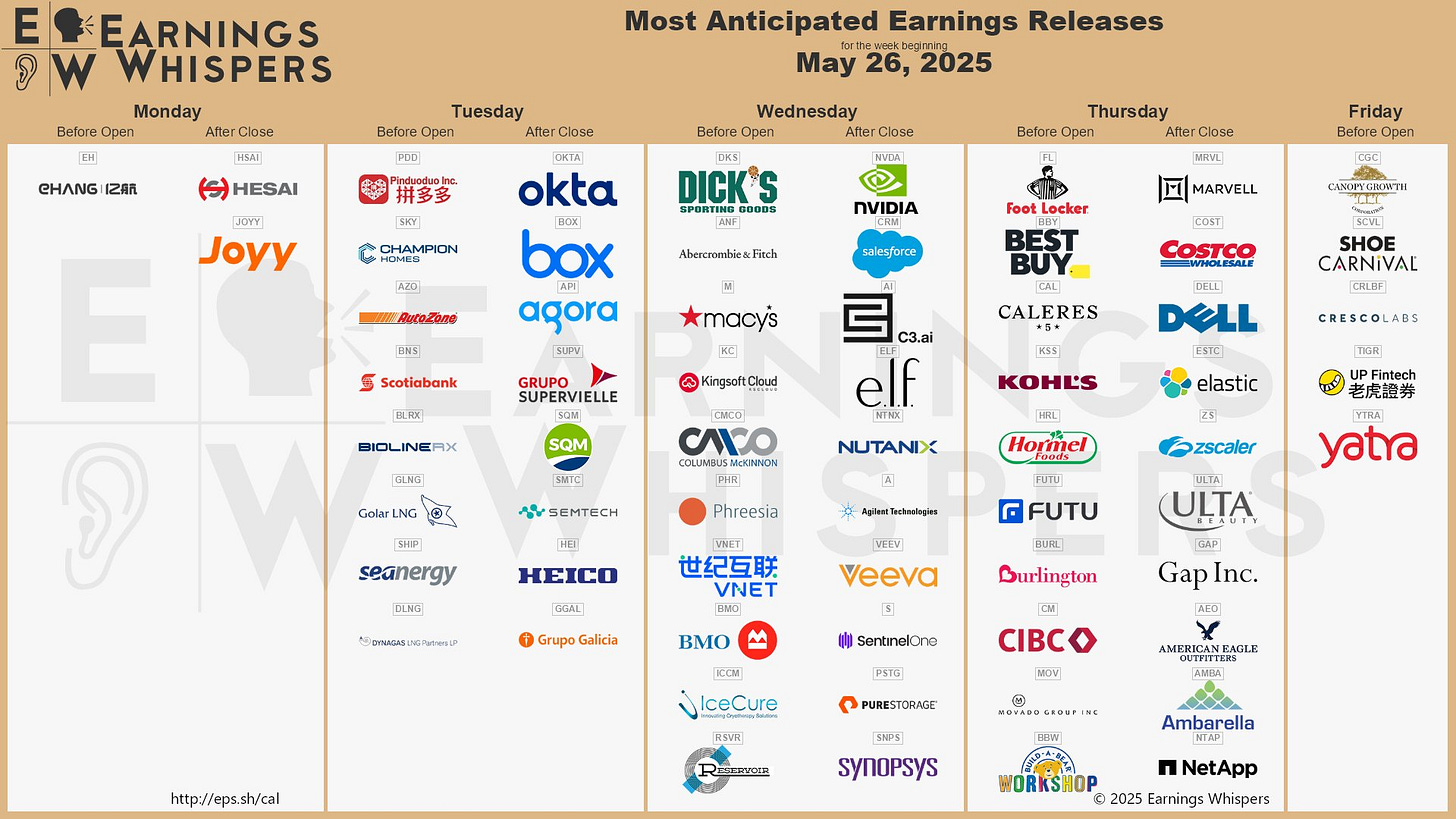

This week, all eyes are on NVDA earnings after market close on Wednesday.