First off, a farewell to my Small Cap 6 Portfolio.

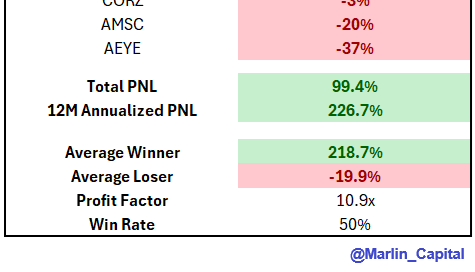

I exited these positions in full last week, locking in +99.4% gains overall in just over 7 months (+226.7% annualized gain).

To ultimately have long term success in the market, you must make sure you get paid when you are right. One of the GOATs in the investing world, Stanley Druckenmiller, has always stressed the importance of maximizing gains when you are right and minimizing losses when you are wrong. In a 2018 Bloomberg interview, he elaborated on this concept:

"It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong."

Stanley Druckenmiller

This concept is known as asymmetric risk/reward investing. Ensuring that the upside of your correct call far outweighs the downside of your incorrect call is how you put yourself in a position to succeed as a trader/investor. Here’s how it played out in my Small Cap 6 Portfolio: