The Moment of Truth

NVDA earnings, big tech, and a full preview of the week ahead + my top trade idea

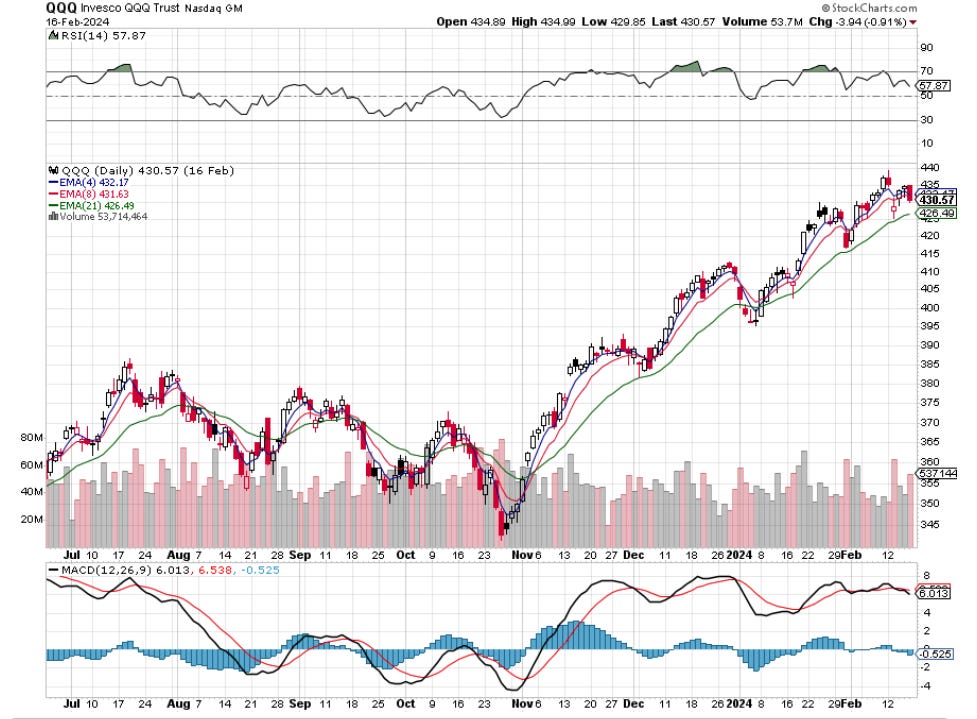

After trading higher for 14 of 15 weeks, the NDX stumbled last week – falling -1.5% - as rates backed up (US 10 YR 4.3%) amidst hotter inflation prints (CPI, PPI).

Last week’s inflation data caused the Fed Funds Futures market to further push back the first Fed rate cut to the June FOMC meeting. The futures market is now pricing in just shy of 4 rate cuts for 2024 (versus the consensus 6+ coming into 2024).

In tandem with the move in rates, we saw a sharp late week reversal in momentum as Goldman’s Momentum pair reversed 350 bps on Thursday/Friday, following a red hot stretch that saw the factor’s 14d RSI erupt to 87. Below is the weekly scoreboard: