Repositioning Rally

This "hated rally" has been driven by re-leveraging back into US stocks. In this report, I analyze the setup going forward and what inning we're in on this rally...

Big rally for US stocks last week with the SPX +4.6%, NDX +6.4%, and RTY +4.1%. The NDX is now positive (+1%) for the month of April. What a wild month it has been.

On Liberation Day (4/2), the S&P 500 closed at $5670. Following the market close on 4/2, we got our first look at the now infamous tariff board. 4 days later (4/7) the S&P 500 made its local low of $4835 (-21% off highs). Last week, we closed at $5525, recouping all but ~2% of the post-Liberation Day move.

So, how did we get here and what is the set up going forward?

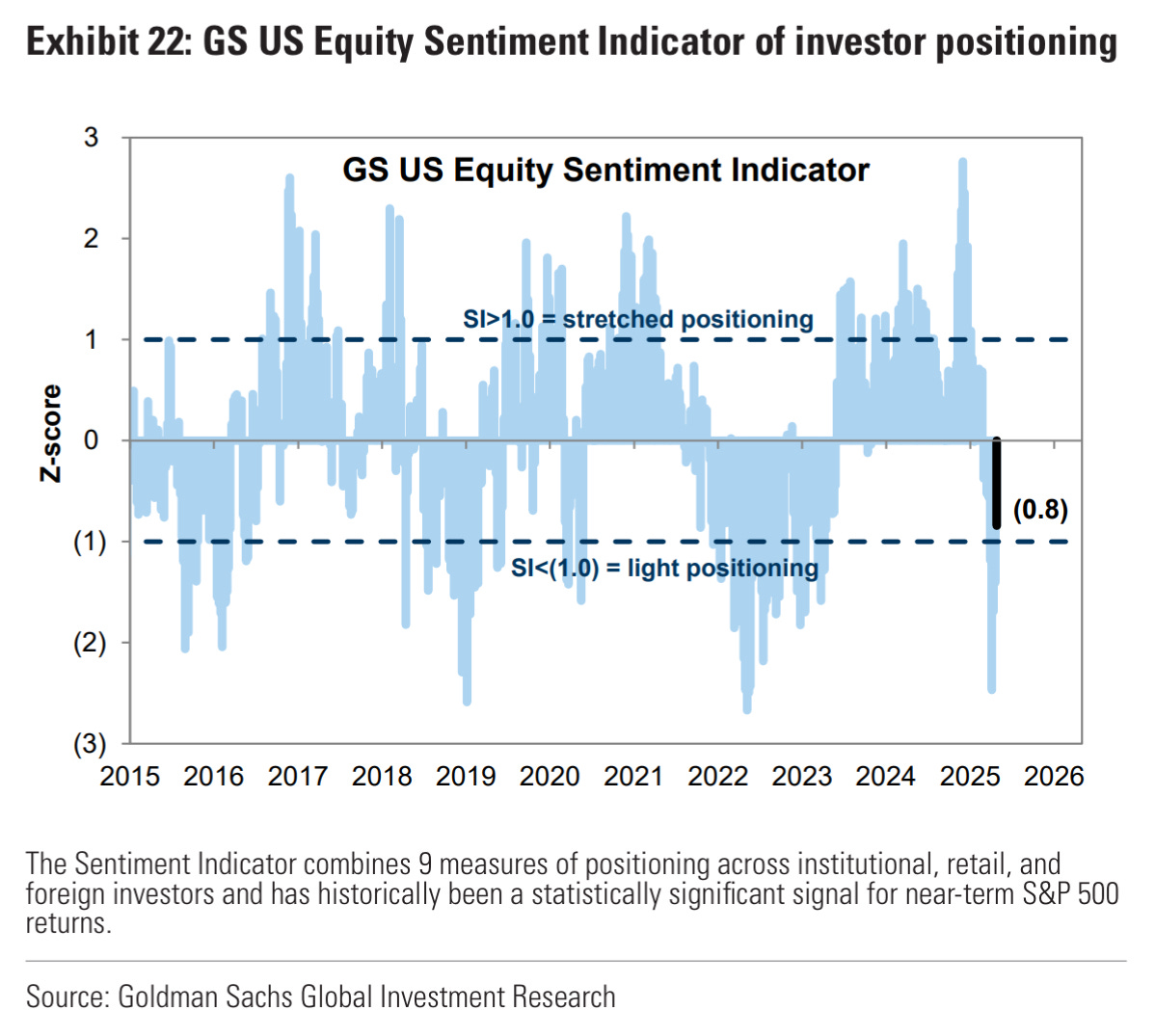

I continue to point back to the historic de-risking we saw in US equities in February and March. We exited January at ATH total long positioning across institutional, retail, and foreign investors. Everyone, and I mean everyone, was “All In” US stocks.

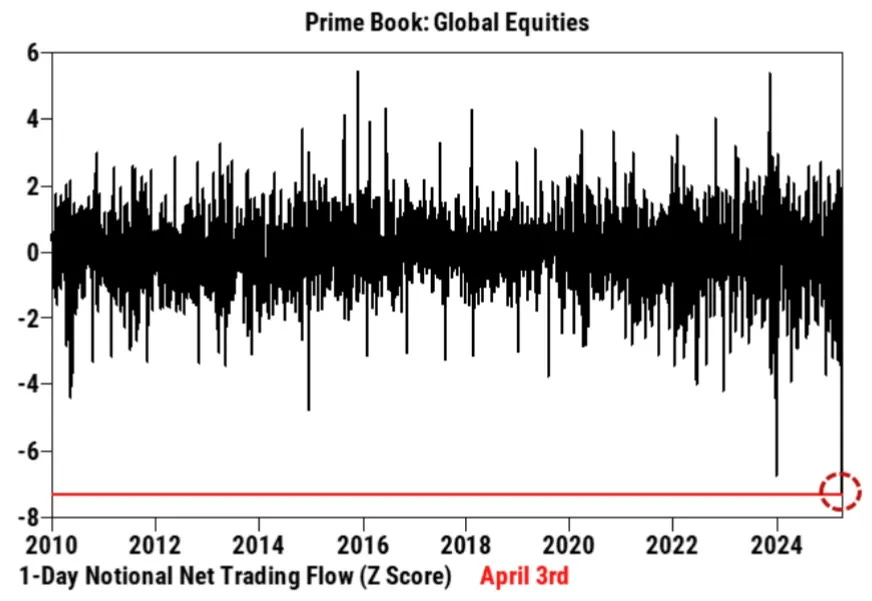

From there, we saw some of the sharpest de-risking and PnL destruction within the Hedge Fund community that we have ever witnessed. I covered this historic HF selling in reports like “The Big Unwind” and “Positioning Cleanse”. This culminated with the largest HF net selling day ever on April 3rd (the day after Liberation Day).

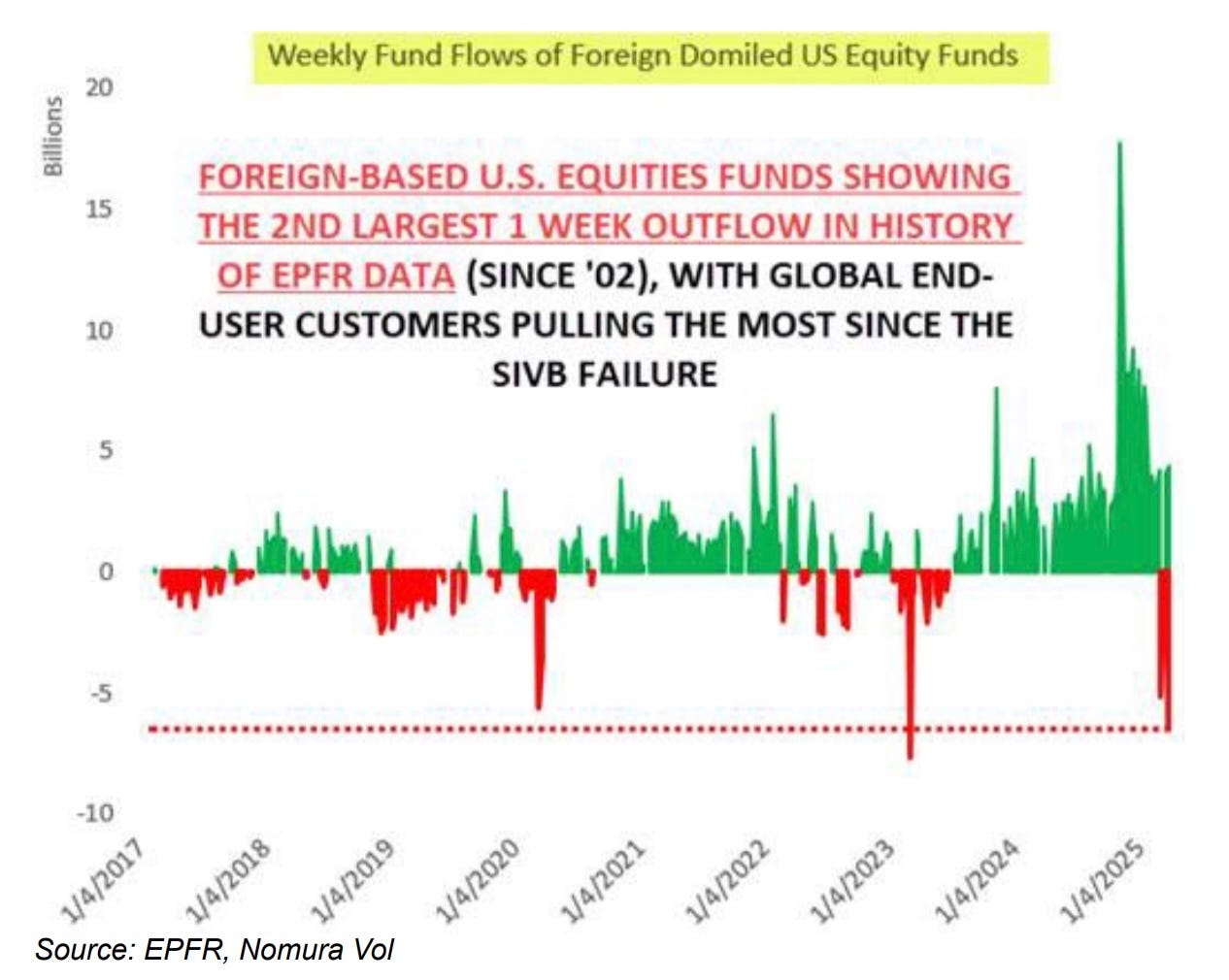

The de-risking was not limited to Hedge Funds, though. Foreign investors also dumped US stocks at the 2nd fastest pace since 2002.

Total positioning reached -2.5z, near 15 year lows.